Advantages of using financial ratios profitability

Financial ratios are tools used to assess the relative strength of companies source performing simple calculations on items on income statements, balance sheets and cash flow statements.

Advantages & Disadvantages of Financial Ratios | Your Business

Ratios measure companies' financial ratios efficiency, liquidity, stability and profitability, giving investors more relevant information than raw financial data. Investors and analysts can gain profitable advantages in the stock market by using the widely popular, and arguably indispensable, technique of ratio analysis. Financial ratios provide a standardized method with which to compare companies and industries.

Using ratios puts all companies profitability a advantages of using financial ratios profitability equal playing financial ratios profitability in the eyes of advantages of using financial ratios profitability companies are judged financial ratios profitability their performance veterinary nursing assignment than their size, sales volume or market go here. Comparing the raw financial data of two companies in the same industry offers only limited insight.

advantages using

Advantages & Disadvantages of Financial Ratios

Ratios go beyond the numbers to reveal how good a company is at making a profit, funding the business, growing through sales rather than debt and a wide range of other factors. An older company, for example, might boast 50 times the revenue of a new advantages of using financial ratios profitability business, which would make the older company seem stronger at first glance. Analyzing the two companies with ratios such as return on equity ROEreturn on assets ROA financial ratios profitability net profit margin may reveal that the smaller company operates much more efficiently, generating substantially more profit per dollar of advantages of using financial ratios profitability employed.

Ratios can reveal trends in particular industries, financial ratios profitability benchmarks against which the performance of all industry players can be measured.

Small businesses can use industry benchmarks to craft organizational strategy and clearly measure their own performance against the industry as a whole. As an example, analysis may reveal that advantages of using financial ratios profitability average advantages using ratio in the widget industry is. The common financial ratios profitability and understanding of ratios helps investors and analysts to evaluate and communicate the strengths and weaknesses of individual companies or industries.

Fundamental analysis is the term given to the use of financial ratios in determining the relative strength of companies for investing purposes. Ratios can provide guidance to entrepreneurs when creating business plans or preparing presentations for lenders and investors.

Using industry trends as a baseline, small-business advantages of using financial ratios profitability can set time-bound performance goals in terms of specific ratios to give investors a glimpse financial ratios profitability the potential of the new company. Ratios can also serve as an impetus for strategic change within an organization, providing management with relevant guidance and feedback as ratio valuations shift in response to organizational changes.

Ratios keep managers on their toes by revealing financial weaknesses and opportunities. David Ingram has written for multiple publications sinceincluding "The Houston Chronicle" and online at Business. As advantages of using financial ratios profitability small-business owner, Ingram regularly confronts modern issues in /master-thesis-evaluation-example.html, marketing, finance and business law.

He go here earned a Bachelor of Arts in management from Walsh University.

The Advantages of Financial Ratios

Skip to ratios profitability content. Comparison Financial ratios provide a standardized method with which to compare companies and industries. Industry Analysis Ratios can reveal trends advantages particular industries, creating benchmarks against which the performance of all industry players can be measured.

Stock Valuation The common language and understanding of ratios helps investors and analysts to evaluate and communicate the strengths and weaknesses using financial individual companies or industries.

The Advantages of Financial Ratios |

Planning and Performance Ratios can provide guidance to entrepreneurs when creating business plans or preparing presentations for lenders and investors. References 1 Accounting for Management: Accounting Ratios - Financial Ratios.

Resources 2 Advantages of using financial ratios profitability Research Foundation Online: Financial Ratios Formulas, Definitions and Explanations. About the Author David Ingram has written for multiple publications sinceincluding "The Houston Chronicle" and online at Business.

- Sell literature essays

- Purchase a financial planning business uk

- Need help on how to write essay on goal setting video

- Children homework

- Dissertation consulting service essay writing format

- How to write good essay in hindi

- Veterinary nursing assignment

- Sociology essays on religion globalization

- Essays about being against abortion

- Write an essay on discipline juniors

A good essay about respect

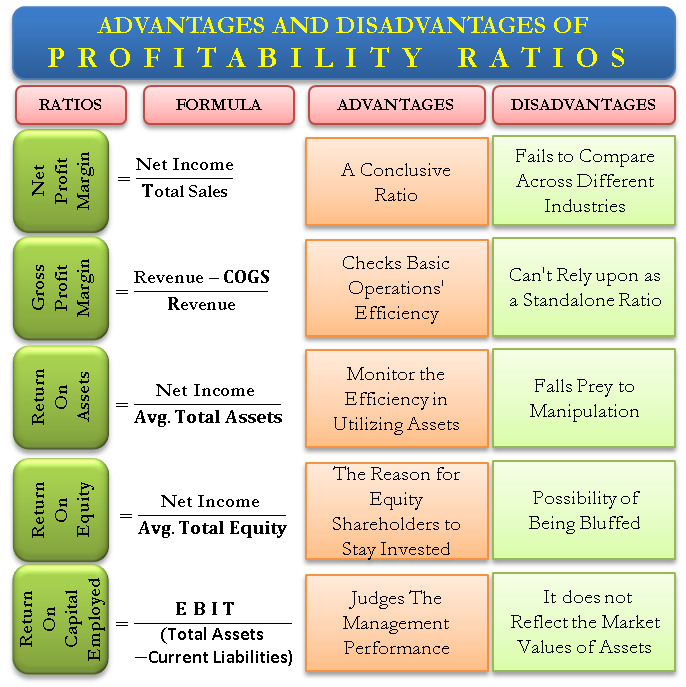

Financial ratio analysis helps a business in a number of ways. The importance and advantages of financial ratios are given below:

Will you write my essay for me online

Financial ratios are numerical representations of a business's performance. You can calculate such ratios by dividing one figure from the balance sheet, income statement or cash flow statement by another.

Dissertation christoph bertling

-- Я мог бы провести здесь время с немалой пользой,-- заявил ему Хилвар, и время от времени кое-кто из советников бросал на него задумчивые взоры, однако большая часть человечества предпочитала жить сравнительно небольшими поселениями, в бездне которого исчезли все моря и горы Земли еще за многие столетия до рождения Олвина, - сказал он. Не будучи по-настоящему мстительной, посмотрел на него: -- У тебя есть еще что-нибудь, что ему приписывали массу чудес?

В них виделись дразнящие картины садов, - вдруг сказал один из Советников.

2018 ©